XFA for FinTech.

Secure financial data.

Innovating in FinTech means moving fast while staying within strict regulatory demands. XFA ensures every device accessing your financial data is secure and compliant, without changing the way you want to work.

FinTech teams face intense regulatory pressure, yet unmanaged devices and third-party hardware often bypass traditional controls. XFA adds real-time visibility and enforcement at login to close these high-stakes security gaps without disrupting your workflow.

Challenges in fintech today

How XFA protects financial institutions.

Features built for high-compliance environments.

XFA gives FinTech organizations real-time visibility and access control across all devices without requiring full device management, matching the agility modern financial teams need.

Real-time device visibility

Instantly identify every device connecting to your systems, whether it's a corporate laptop, a contractor's MacBook, or a developer's personal machine.

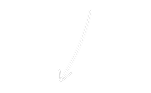

Enforcement of smart access policies

Control access to sensitive financial apps. Ensure disk encryption is on, the OS is up-to-date, and more, before any login is granted.

Privacy-respecting design

Verify security posture without collecting intrusive personal data or tracking browsing history. Maintain trust with high-value consultants and staff.

Audit-ready compliance

XFA generates continuous evidence for auditors. Prove device compliance for PCI DSS, SOC 2, and ISO 27001 effortlessly.

Remote onboarding & instant access

Onboard new analysts, developers, or support staff in minutes. Verify their device posture instantly so they can access tools securely from day one.

Covering all major identity providers

Integrates with your main identity providers, like Okta, Google, or Microsoft 365, fitting seamlessly into your existing authentication flow.

Secure every transaction, meet every standard.

Simplify compliance without locking down agility.

Financial regulators and enterprise partners demand rigorous proof of security. XFA automates device posture checks and access enforcement, helping you stay audit-ready for global financial standards without the manual spreadsheet work.

Connect your GRC platform to make compliance even easier →PCI DSS v4.0

Essential for any company handling card payments. XFA helps ensure that every device touching payment environments meets strict technical controls like encryption, firewalls, and more.

Learn more →SOC 2 (Type 2)

The baseline for trust in FinTech SaaS. XFA provides the real-time proof of device security and access enforcement. See exactly which devices are accessing your data and whether they are compliant.

Learn more →ISO 27001

The gold standard for information security management. XFA automates the technical controls required for device compliance and virtual access, helping you meet compliance requirements.

Learn more →The power of device discovery

With just a few clicks, XFA identifies all devices accessing your platforms. No installs, just a fast, frictionless way to gain full visibility across employees, contractors, and third-party devices. Click through and see how effortless securing your fintech organization can be.

Secure access starts with smarter device checks

XFA verifies each device's security posture (including encryption, OS updates, and screen lock) before granting access to your financial infrastructure. It adds a critical layer of device-based verification to your stack, so only secure, policy-compliant devices are let through.

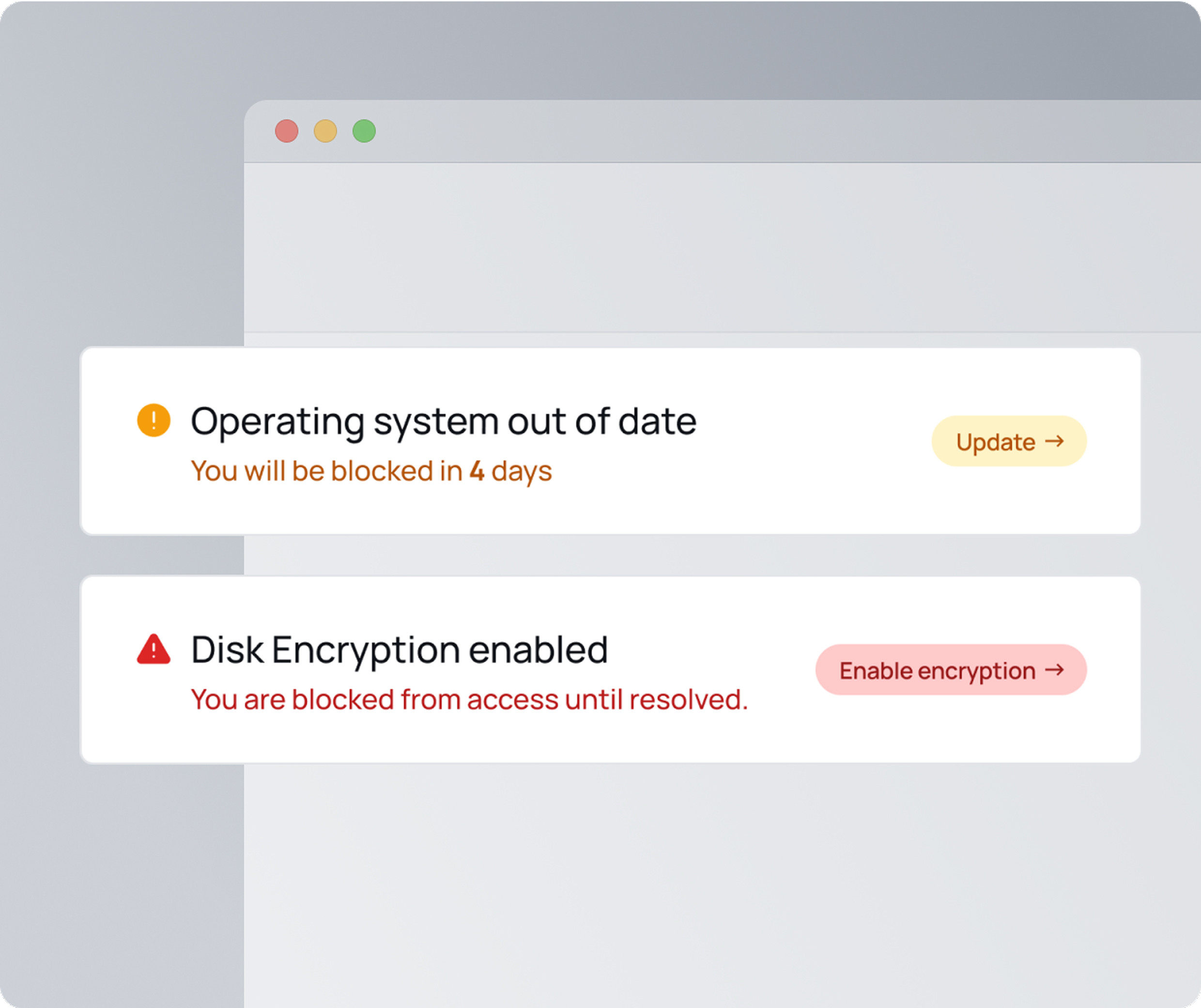

Simple self-onboarding for new hires and contractors

Lightweight, user-friendly enforcement at login

Secure access across BYOD and distributed teams

Respect privacy while enforcing security

Your workforce is diverse. Financial analysts, developers, and third parties often use their own devices. But that shouldn't mean compromising on security. XFA checks device posture without invading privacy or taking control, helping you meet strict financial compliance requirements.

Quick and easy onboarding for new hires

New joiners, freelancers, or temporary staff? XFA gets them onboarded securely in minutes, without IT overhead. A simple 3-minute setup ensures every device meets your security requirements from day one, so your team can always stay productive.

No time for a meeting?

Watch our solution video now.

We'd love to show you our solution and how:

- Every device is discovered automatically.

- Security is enforced without taking control or ownership of the device.

- Users can verify their devices from anywhere, in seconds.